does life insurance cover mortgage protection

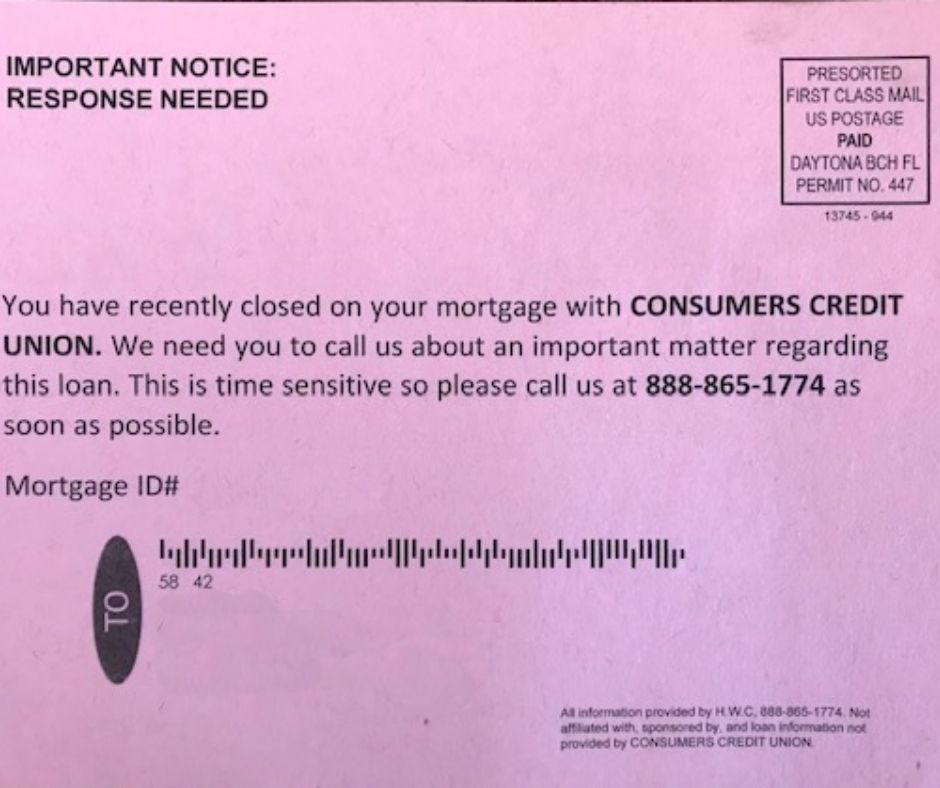

Scammers may use data from public sources to reach potential victims, such as in the example below. Scammers might want to take your cash, but a lot are also searching for your data to steal your identity, which means more than your money is at risk.

If you just recently purchased a home or refinanced your mortgage, you will likely receive many offers in the mail for "Mortgage Life Protection" or "Mortgage Life Insurance." In this article, we will take a look at the pros and cons of Mortgage Protection Insurance. You can answer the question: Is Mortgage Protection Life Insurance a scam or a smart move?